Mortgage advice you can trust

Let me navigate you through the process of

successfully achieving your mortgage goals

MICHAEL HALLETT

Passionate about Mortgages, Mountain Biking and Craft Beer

Mortgage financing can be frustrating. It doesn't have to be when you follow this

3 step plan.

Get started right away

The best place to start is to connect with me directly. The mortgage process is personal. My commitment is to listen to all your needs, assess your financial situation, and provide you with a clear plan forward.

Get a clear plan

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming. Let me cut through the noise, I'll outline the best mortgage products available, with your needs in mind.

I'll handle the details

When it comes time to arranging your mortgage, I have the experience to bring it together. I'll make sure you know exactly where you stand at all times. No surprises. I've got you covered.

Thank you for coming to check my website. If you only have time to read one paragraph, I can summarize everything below in one sentence. I’m a 13-year veteran mortgage broker, addicted mountain biker for over 26 years, passionate big mountain skier for even longer, rookie dirt biker, outdoor enthusiast for over 45 years and lover of craft beer.

As a BC boy born and bred, I can proudly say I’ve lived my entire life in BC. Growing up on the north end of Vancouver Island in a small logging town (Holberg), it helped cement my love for the outdoors. From there we moved to the Coquitlam area when I was 10 years old where my dad opened a business with my uncle.

After graduating high school, I moved to Victoria for 1 year where I enrolled in an Outdoor Eco-tourism Program. From there my then girlfriend and I, now my wife Kirstin, moved to Whistler to pursue a lifestyle of playing and working outside. It was there that my entrepreneurial spirit had started to take shape. Over the next couple of years, I self-started two small businesses in the tourism industry including a guided mountain bike adventure company.

It was around this time in Whistler that Kirstin and I bought our first home and I started to become interested in the mortgage financing space. Our son Aidan was born in 2007 and a year later we decided to move back to Coquitlam to pursue different careers. After purchasing our second home in 2008, I knew that I wanted to make a career out of being a Mortgage Broker, so I did. I have been assisting clients achieve their goals of real estate ownership since August 2009. Currently I am ranked in the top 5% of brokers at Dominion Lending across Canada. In 2021 I received the DIAMOND award for my mortgage practice.

When we are not working or Aidan’s not in school you can usually find us being active somehow; hiking, mountain biking, skiing, camping, boating, playing hockey, golfing, traveling or on the road headed out on our next adventure. We love being busy and we would not have it any other way!

On a more personal note...

BEERS, BIKES & MORTGAGES

I am passionate about mortgage brokering, mountain biking and craft beer.

My commitment is to navigate you through the entire mortgage process, guiding you every step of the way. I have the ability and experience to help you achieve your mortgage goals.

Mountain biking is a true lifestyle and I absolutely love it. I also enjoy good tasting beer and Parkside Brewery is one of my favorite places.

Watch my 'Beers, Bikes & Mortgages' video here.

Everything you need, all in one place

As a trusted mortgage provider, I can help you with these services.

Obviously there are a lot more services I can offer and a lot more information I can share with you. Consider this my invitation to contact me with your questions, I would love to work with you and help you figure out a plan not only to get you a mortgage, but to help you get rid of it.

BURKE MOUNTAIN DEVELOPMENTS

If you are looking to purchase a home in the new Burke Mountain Development, I know the project very well and would love to help you arrange mortgage financing. I live in Coquitlam and spend most of my free time in Pinecone Burke Mountain Provincial Park. If you are looking for an inside man to help you navigate the area, you’ve found him.

Okay, so maybe a calculator really isn’t a service, but if you click through this link, it will take you to a page with a some really fun options to run some calculations on your own. When you have things somewhat figured out, give me a shout and we can see exactly where you stand.

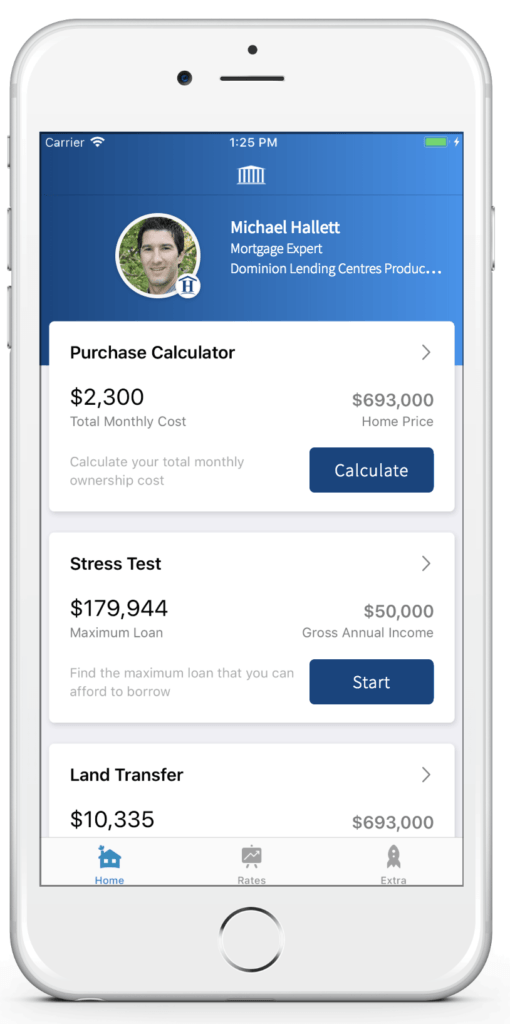

DOWNLOAD MY MORTGAGE TOOLBOX

WHAT CAN YOU DO WITH MY APP:

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

TESTIMONIALS

SUBSCRIBE TO MY NEWSLETTER

FROM MY INSTAGRAM

NEWS FROM THE DESK OF MICHAEL HALLETT